By John Gerstner, Vice President, Insureous Health Solutions

There’s a saying in business that rings especially true here at Insureous Health Solutions: “Smart clients make you smarter.” We’ve had the good fortune to work with many smart (and demanding) clients over the years. Here are some of the things we’ve learned about the ins and outs of offering group health insurance to employees.

- Group health insurance helps attract and retain good employees. It’s a well-proven fact that employee benefits are a glue for helping employees stick with you through good times and bad. And the better the benefits, the stronger the glue. Good benefits such as health insurance fuel a sense of appreciation and make it harder to jump ship. If employees feel protected, they’re more likely to stay and contribute.

- Group health plans can offer better coverage at less cost than individual plans. In fact, Insureous has helped some small business owners save money on their individual family plan by introducing a group plan for their staff. If you are a small business owner, you may also see the advantage of switching to a group plan and helping your employees get health insurance. Insureous be happy to run the numbers.

- You do not have to be a big company to offer group health insurance. Don’t be fooled into the myth that you need at least ten or more employees to set up a group health plan. Some agencies won’t work with small companies, but Insureous will. We work with all the major insurance carriers and can set up plans with as few as four employees, including the owner.

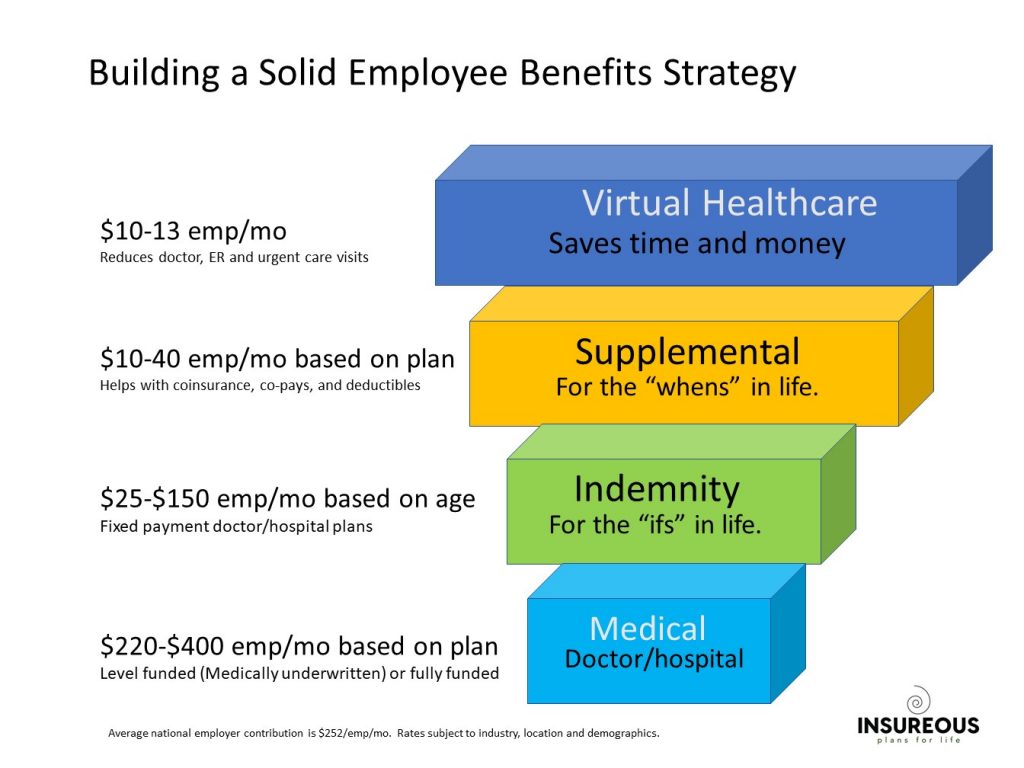

- You can start by offering supplementary benefits at no cost to the employer. If biting off a group medical plan seems like too much, there are lots of alternatives. You can simply allow your employees to buy supplementary (also known as voluntary) benefits without the company contributing to the plans. This allows employees to buy such coverage as dental, vision, accident, critical illness, cancer, life and disability coverage at group rates. Employees can take their coverage with them if they leave your employment. And since the plans are pre-taxed, you save in federal payroll taxes.

- Adding and managing a group health insurance plan shouldn’t be a formidable burden. With the option of online enrollment, Insureous streamlines the employee education and enrollment process, requiring minimal time for both employer and employees. We also function as your ambassador to iron out any billing issues, handle new hires and termination changes and help employees with claims questions. We even coordinate payroll deductions with your accountant if you wish.

Bottom line: if you are an employee at a company that doesn’t offer any benefits, or a business owner on the fence about offering a group health insurance plan, or would simply like to see other options for your next open enrollment, contact us or call 904-295-8498.