Original Medicare covers a lot—but not everything. You’re still responsible for deductibles, coinsurance, and other out-of-pocket costs.

Medicare Supplement Insurance (also called Medigap) helps fill those gaps—so you don’t get hit with surprise bills after a hospital stay or doctor visit.

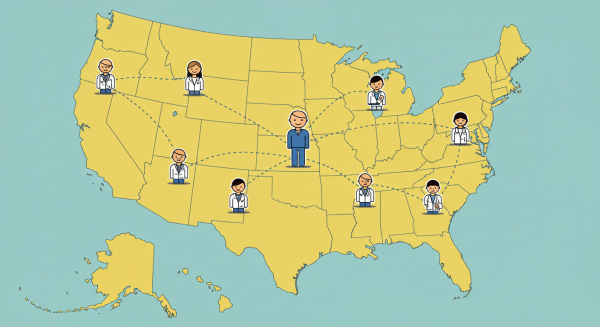

🛡️ Nationwide coverage without networks.

✅ What Medigap Covers

- Medicare Part A deductibles and coinsurance

- Medicare Part B copayments and excess charges

- Skilled nursing facility coinsurance

- Foreign travel emergency coverage (on some plans)

It pays after Medicare does—so you can worry less about what’s not covered.

🔍 How Medigap Works

- You stay on Original Medicare (Parts A & B)

- You add a Medigap plan from a private insurer

- Medicare pays first, then Medigap pays its share

- You pay a monthly premium for your Medigap plan

- You can see any doctor or hospital that accepts Medicare—no networks!

🧭 Who Should Consider Medigap?

It’s a great fit if you:

- Prefer nationwide freedom of choice

- Travel frequently or live part of the year in another state

- Don’t need extra benefits like dental or vision

- Want predictable costs and minimal surprises

- Are willing to buy Part D separately for prescription coverage

⚠️ What Medigap Does Not Cover

- Prescription drugs (you’ll need a separate Part D plan)

- Dental, vision, or hearing

- Long-term care or routine foot care

Also: Medigap only works with Original Medicare—not with Medicare Advantage.

👥 How We Help

- Compare all Medigap plans (A–N) side-by-side

- Explain the differences between plans and pricing

- Check state-specific rules and enrollment deadlines

- Coordinate Medigap with your Part D drug plan

- Make sure your total coverage fits your health, travel, and budget needs

📞 Let’s Talk Coverage

Not sure if Medigap or Medicare Advantage is right for you?

We’ll help you compare and choose with confidence.

👉 Schedule a Free Medicare Review or call 904-295-8498.